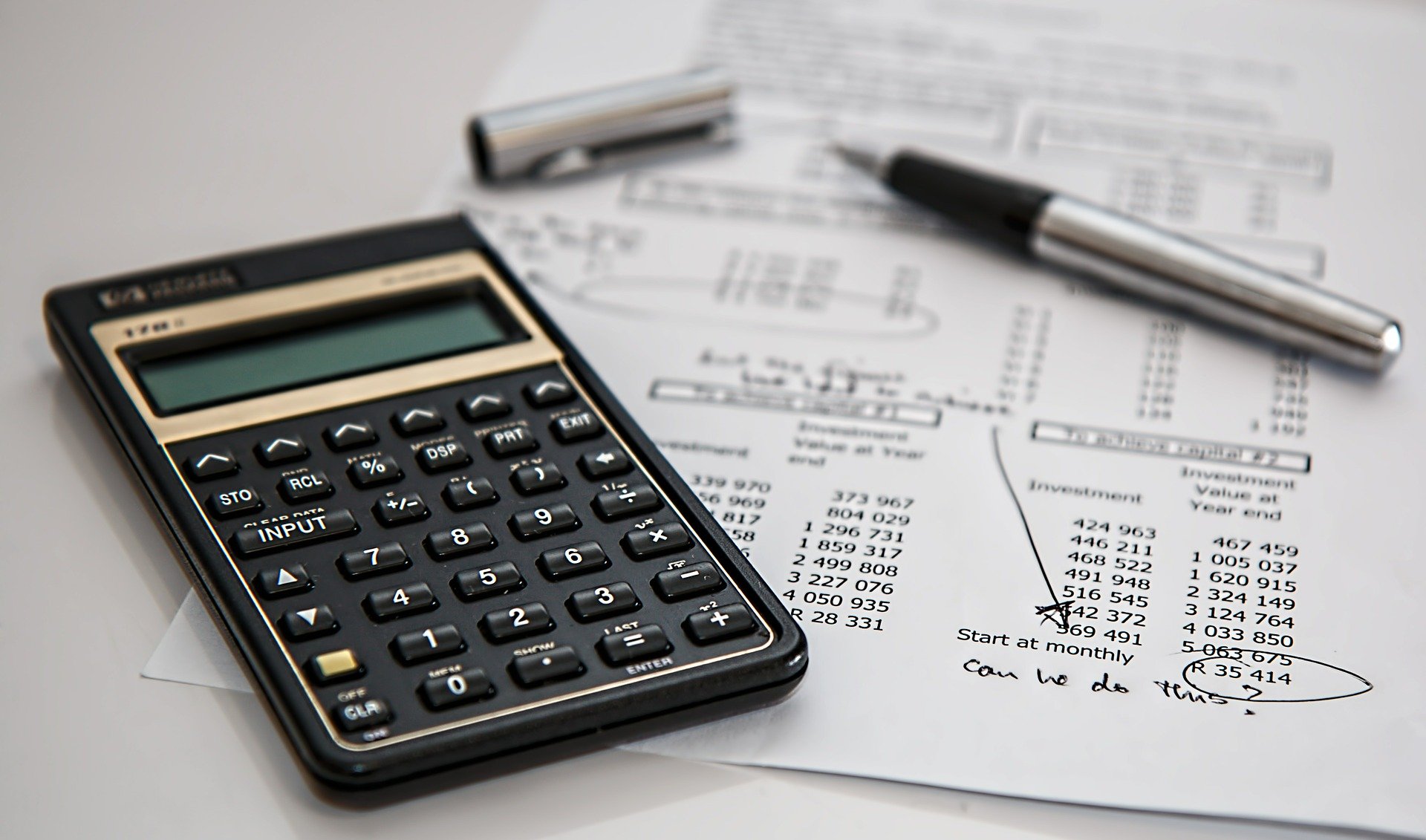

Some customers come to us asking how we can help them have a better idea of what items are going to end up costing once landed when not only the cost of materials are considered, but also other miscellaneous charges such as freight, drayage, warehousing, etc. will impact the total cost of an item.

A landed cost is the total charge associated with getting a shipment to its destination. It refers to the cost of shipping, plus applicable duties, taxes and fees, handling of the goods, storage, insurance, etc.

An example of landed cost is if I am shipping 1000 tons of product on a container. I would take the cost that the supplier is charging me for the goods themselves (FOB Cost); let’s say it is $200 per ton to get the total material cost of 200,000. In addition, I would add the freight of $1500 for the entire container, storage and handling fees for warehousing, which is another $1500, Duty adds $6000, and Broker Fees for $600. The total amount that I would be paying for these goods to be shipped to my customer would be $209,600. To find out my landed cost for 1 ton I could divide $209,600 by 1000 to get $209.60/ton. That means I am paying 9 dollars and 6 cents for all miscellaneous charges on top of the cost of the material. We are able to dial in the cost estimation (latest projected cost, or LPC) through a few different key aspects of the VISCO interface.

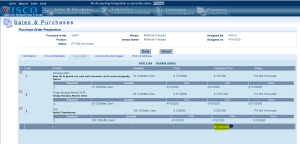

The first is with Accruals. In VISCO we have accruals that act as place holders for items such as freight until the cost is being applied. Once the cost is applied, the accrual falls away. This makes it so you always have the most up to date information when considering your gross profit. Accruals work in a few different ways. The first way is by the Purchase Order itself. The Purchase order total material amount is the first thing that is considered when figuring out cost applied to a specific shipment of goods. The Material cost is calculated based on quantity shipped x price per unit on the Purchase Order.

The second is on the container itself. Since containers can be made up of goods from several different purchase orders, we have an estimated costs tab that allows users to apply costs to be distributed against all of the items that were added to the container, not dependent on the PO they came from. Users can choose to either enter manual costs or have cost estimations automatically calculated to be applied to an entire container.

For example, a user might enter 200 dollars as a container accrual for freight. Some people might have separate rates depending on the type of shipment. The accruals would then calculate by dividing the cost across all of goods on the entire container. The total cost of the freight is being applied to the container, but there are many ways that a freight charge can then be distributed against all of the items on the container. We call this the distribution method.

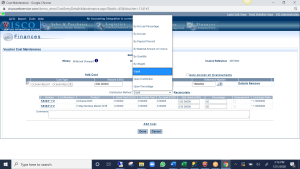

When the cost is being added once vendor invoice is received, they are entered into the accounts payable section of VISCO entitled ‘Cost Entry’. The user can choose first how they would like the cost applied. Is it to an entire container? Or is it to a bill of lading with several containers on it? Does the charge apply to the Purchase Order? Or does it apply to a specific item that is on a Purchase Order or Container?

After the user decides what is best for the given situation, they can choose the distribution method which allows them to decide how they would like the charges to be distributed against the Purchase Order, Container, Bill of Lading, etc. If the user chooses to apply a freight charge to a container, they can decide that each specific good on that container, should be getting an equal cut of the freight charge. So if I have twenty items on a Container, all from different Purchase Orders, and I apply 200 dollars equally distributed against the entire container, each item will have 10 dollars of freight, plus any additional charges and material to help the user get an idea of what is actually being spent on a product.

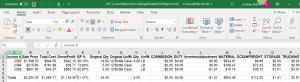

The user will see a break down of this in a few different ways within the system. The first way is in Gross Margin Detail Reporting, which is essentially a Profit and Loss report. This is a report that gives the user exact percentage of profit for every item by considering the LPC (with accruals and actual costs) being applied, subtracted from the amount that the customer is being charged for the allocated item on corresponding Invoices.

The second way to see the specific Latest Projected Costs, Latest Actual Costs, Open Accruals that have yet to be paid, and Costs that have been paid, is with our report called ‘Venture Analysis’.

Many consider these tools the biggest strengths of the system because it allows a company true costing and profit analysis on the goods they sell.